The United States offshore wind industry is entering a decisive phase.

After years of planning, leasing, and early construction, the period from 2026 to 2030 will determine whether offshore wind becomes a foundational pillar of the U.S. energy system—or remains a slower-moving niche technology.

This roadmap is not just about turbines in the water. It reflects policy stability, supply chain maturity, grid readiness, financing confidence, and state–federal coordination. While early projects faced delays and cost pressures, the next five years are expected to define the industry’s long-term trajectory.

As outlined in our Offshore Wind Energy Explained guide, offshore wind is central to U.S. decarbonization, coastal energy security, and industrial revitalization. The question now is not whether offshore wind will grow—but how fast, where, and under what conditions.

Why 2026–2030 Is a Critical Window for US Offshore Wind

The offshore wind timeline is front-loaded with complexity.

Leasing, permitting, environmental review, financing, and supply chain development often take 7–10 years before electricity reaches the grid. That means projects delivering power between 2026 and 2030 were largely conceived years earlier.

This window matters because:

- First utility-scale projects will reach full operation

- Federal leasing areas transition into construction zones

- State procurement targets move from paper to delivery

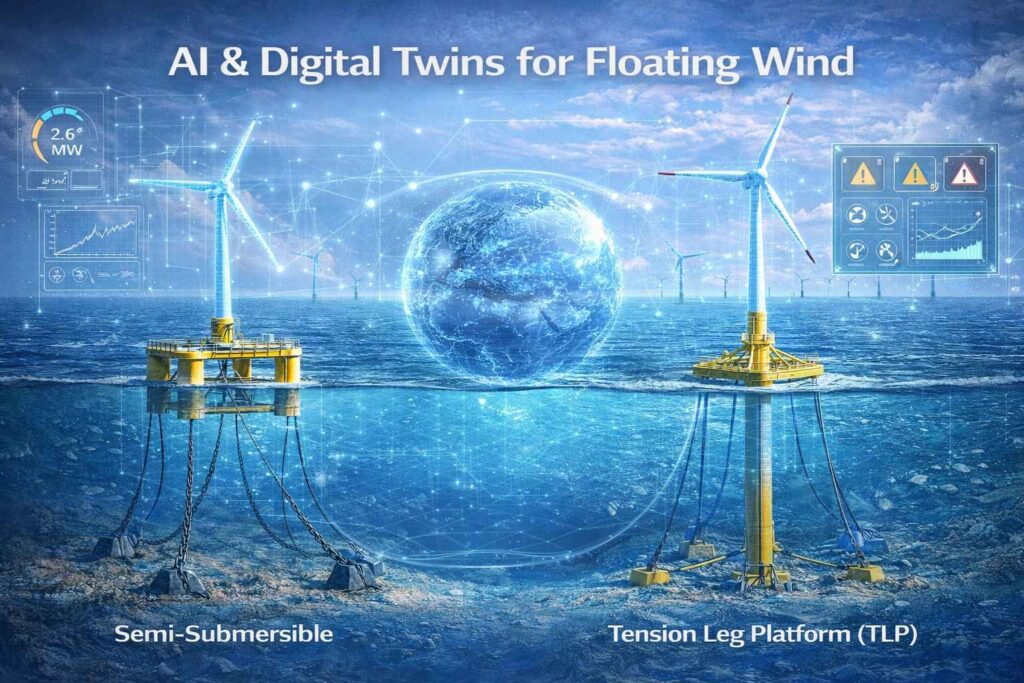

- Floating offshore wind enters early commercialization

Success—or failure—during this period will shape investor confidence well into the 2030s.

Current Status of US Offshore Wind (As of 2026)

As of early 2026, the U.S. offshore wind sector is moving from pre-commercial to early commercial deployment.

Key characteristics of the current market include:

- Operational projects remain limited but expanding

- Most capacity is concentrated on the East Coast

- Federal leasing has accelerated under BOEM

- Supply chain localization is still incomplete

The industry has faced headwinds, including inflation, interest rate volatility, and contract renegotiations. However, these challenges have also forced structural improvements in procurement models and risk allocation.

US Offshore Wind Capacity Outlook (2026–2030)

Expected Installed Capacity Growth

Between 2026 and 2030, U.S. offshore wind capacity is expected to move from single-digit gigawatts to multi-tens of gigawatts, depending on project execution and policy continuity.

While projections vary, the roadmap generally includes:

- Initial large-scale power delivery from East Coast projects

- Incremental annual capacity additions

- Early floating offshore wind pilots entering construction

This growth phase is less about speed and more about execution quality.

East Coast: Backbone of US Offshore Wind Growth

The U.S. East Coast will remain the backbone of offshore wind deployment through 2030.

Why the East Coast Leads

- A shallow continental shelf supports fixed-bottom foundations

- Proximity to major load centers

- Strong state-level procurement mandates

- Existing port and grid infrastructure

States such as New York, New Jersey, Massachusetts, and Virginia anchor the national offshore wind pipeline.

Projects in this region are expected to:

- Move from construction to full operation

- Establish long-term O&M ecosystems

- Normalize offshore wind power pricing

Many of these developments align with the fixed-bottom offshore wind model described in our Floating vs Fixed-Bottom Offshore Wind Comparison.

West Coast: Floating Offshore Wind Takes Shape

Unlike the East Coast, offshore wind on the U.S. West Coast is defined by deep waters and steep seabed drop-offs.

Why Floating Offshore Wind Is Essential

- Water depths exceed fixed-bottom limits

- Narrow continental shelf

- High wind resources close to shore

As explained in our Floating Offshore Wind Energy Explained guide, floating platforms are the only viable solution for California, Oregon, and Washington.

Between 2026 and 2030, the roadmap includes:

- Completion of early floating wind design and permitting

- Port upgrades for floating assembly

- Initial pilot and demonstration projects

Gulf of Mexico: Emerging Opportunity

The Gulf of Mexico presents a different offshore wind profile.

Advantages include:

- Extensive offshore energy experience

- Established oil and gas supply chains

- Favorable port infrastructure

While wind speeds are lower than in the Atlantic, the region benefits from industrial readiness and workforce expertise. Hybrid energy hubs and smaller-scale projects may emerge between 2026 and 2030.

Federal Policy and BOEM Leasing Outlook

At the federal level, offshore wind is increasingly positioned as a strategic energy resource rather than a niche renewable technology.

U.S. Department of Energy analysis highlights offshore wind’s role in long-term grid reliability, domestic manufacturing, and emissions reduction, particularly as electricity demand grows from electrification and data centers. DOE planning documents also emphasize the need for coordinated transmission development, port infrastructure upgrades, and supply chain investment to support large-scale offshore wind deployment beyond the initial project pipeline.

Key federal drivers include:

- Lease auctions and site designations

- Environmental impact assessments

- Transmission coordination

Policy clarity during this period is essential to maintaining investor confidence.

Grid Infrastructure and Transmission Challenges

Grid integration is one of the most underestimated constraints in the U.S. offshore wind roadmap.

Key Challenges

- Limited offshore transmission planning

- Onshore substation congestion

- Permitting delays for grid upgrades

As offshore wind capacity increases, grid readiness—not turbine availability—may become the primary bottleneck.

Supply Chain and Port Development (2026–2030)

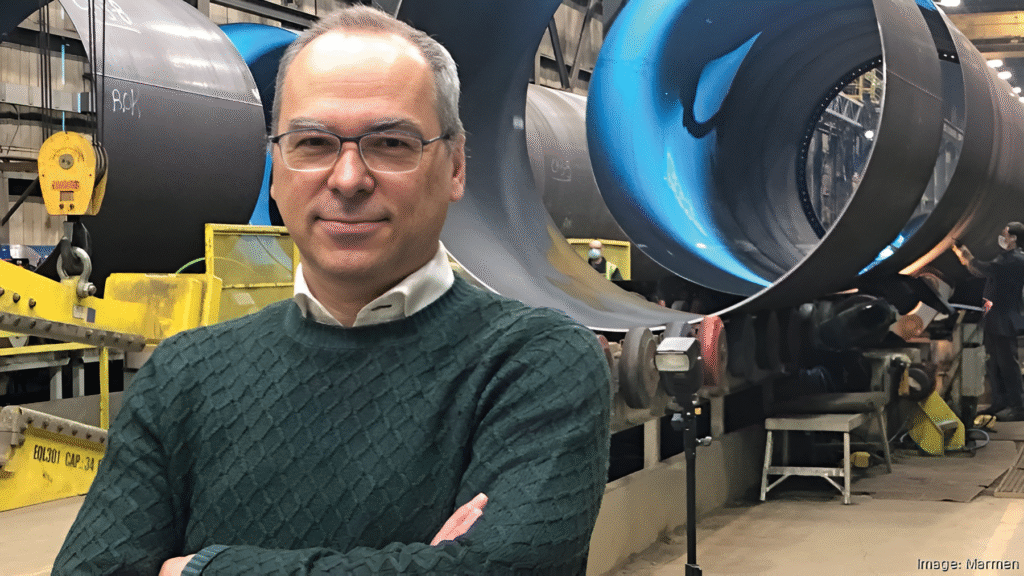

A resilient domestic supply chain is critical to meeting U.S. offshore wind targets. Supply chain readiness remains one of the most critical constraints on offshore wind growth, particularly as projects scale between 2026 and 2030. Global Wind Energy Council (GWEC) market assessments show that port capacity, installation vessels, and localized manufacturing are now the primary bottlenecks for offshore wind deployment globally, including in emerging U.S. markets.

Between 2026 and 2030, priorities for strengthening the supply chain include:

- Turbine assembly ports

- Blade, tower, and foundation manufacturing

- Installation vessel availability

- Skilled workforce development

GWEC has repeatedly highlighted that without synchronized investment in ports and manufacturing, project timelines could face structural delays, regardless of permitting progress.

For a more detailed view of supply chain challenges and solutions, see our Offshore Wind Supply Chain analysis.

Investment, Financing, and Market Confidence

The financial environment from 2026 to 2030 will influence how quickly offshore wind scales.

Key factors include:

- Power purchase agreement (PPA) structures

- Interest rate trends

- Risk-sharing between developers and states

While early projects faced renegotiations, newer procurement models are showing greater flexibility—an essential condition for long-term market stability.

What the 2026–2030 Roadmap Means for the Future

The U.S. offshore wind roadmap through 2030 is less about headline capacity numbers and more about institutional maturity.

By the end of this period, the industry is expected to have:

- Operational reference projects

- A trained offshore wind workforce

- Improved grid coordination

- Early floating wind commercialization

If these foundations hold, offshore wind can scale rapidly in the 2030s.

Frequently Asked Questions

How much offshore wind capacity will the US have by 2030?

Capacity estimates vary, but the U.S. is expected to reach multi-gigawatt operational levels by 2030 if current projects proceed as planned.

Which US regions will lead offshore wind development?

The East Coast will dominate through 2030, while the West Coast will lead floating offshore wind deployment.

Is floating offshore wind included in the US roadmap?

Yes. Floating offshore wind is essential for deep-water regions, particularly along the Pacific Coast.

What are the biggest risks to the roadmap?

Grid delays, supply chain constraints, and policy uncertainty remain the primary risks.

Ismot Jerin is the founder and Editor-in-Chief of WindNewsToday, an independent publication covering offshore wind, renewable energy policy, and clean power markets with an analytical focus on the United States and global energy transition.