Floating offshore wind is becoming a critical pillar of the broader offshore wind energy transition, reshaping U.S. clean power strategy—especially in deep-water regions where fixed-bottom turbines are not viable.

Backed by billions of dollars in public and private investment, floating wind technology offers a path to unlock America’s vast deep-water wind resources along the West Coast, the Gulf of Maine, and parts of the Mid-Atlantic. Yet despite its promise, deployment remains constrained by permitting delays, shifting federal policy, and supply-chain limitations.

Advanced digital technologies are already helping the industry overcome these barriers. Tools such as predictive maintenance, digital twins, and turbine-level automation are reducing operational risk and long-term costs—topics explored in our in-depth guide to AI in wind energy.

Today, the United States holds one of the world’s largest untapped floating wind resources. The question is no longer whether floating offshore wind will transform America’s energy future—but how quickly it can scale amid economic, regulatory, and technological constraints.

As offshore wind policy in 2025 continues to evolve, this guide examines the forces shaping the U.S. floating wind market—from state leadership and federal permitting dynamics to investment signals and global competition.

What This Guide Covers

This comprehensive analysis explains:

- Floating offshore wind technology fundamentals

- U.S. offshore wind policy and political risks

- State-by-state project status (California, Oregon, Washington, Maine, Hawaii)

- Supply-chain readiness and technology innovation

- Costs, financing, and investment outlook

- Global competition and U.S. positioning

- A 2025–2040 market forecast

Understanding Floating Offshore Wind United States

Floating offshore wind refers to turbines installed in deep waters (60–1,200 meters) where fixed-bottom foundations cannot be deployed.

How Floating Wind Works

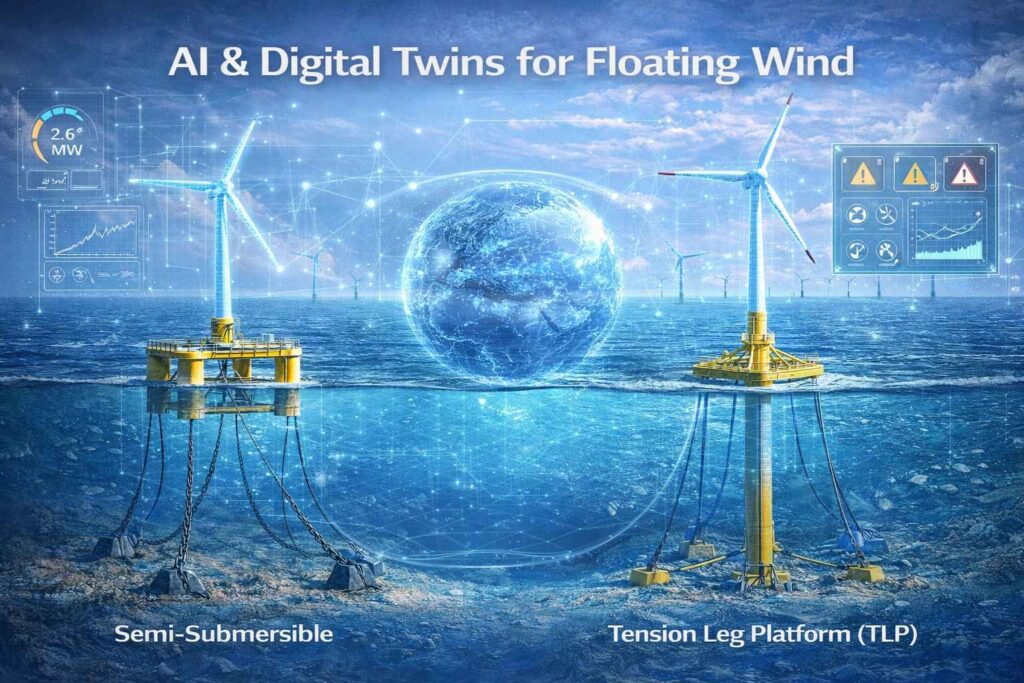

Floating wind turbines are supported by platforms anchored to the seabed using mooring systems and dynamic cables. Common designs include:

- Semi-submersible platforms

- Spar-buoy structures

- Tension-leg platforms (TLPs)

- Dynamic subsea export cables

These systems allow turbines to remain stable while capturing strong offshore winds far from shore.

Why Floating Offshore Wind Matters for the U.S.

- 80–85% of U.S. offshore wind potential lies in deep water

- Fixed-bottom turbines cannot access these regions

- Floating wind could unlock hundreds of gigawatts of clean electricity

According to NREL, the United States has 2.8 terawatts (TW) of deep-water offshore wind potential. By 2045, the West Coast alone could support 25–55 GW of floating offshore wind capacity.

For project-level updates, visit our Offshore Wind Energy Guide

Historical Momentum (Biden Administration 2021–2024)

Before 2025, the U.S. floating wind sector showed strong growth potential:

Federal Actions

- 15 GW floating wind target by 2035

- Accelerated BOEM leasing and environmental reviews

- Tax incentives: ITC, advanced manufacturing credits

- DOE Floating Offshore Wind Shot: cost reduction goal of 70% by 2035

Major Lease Areas

- California: Morro Bay + Humboldt, ~4.6 GW awarded

- Oregon: Planning areas under review

- Washington: Early-stage preliminary studies

Private Investment

Developers such as Equinor, RWE, Ocean Winds, Shell, and Copenhagen Infrastructure Partners began:

- Site surveys

- Port redevelopment planning

- Grid interconnection studies

This created high expectations that the U.S. would soon rival European floating wind deployment.

2025 Policy Reality—Temporary Slowdown

With federal policy shifts in 2025 under the Trump administration, the floating offshore wind sector faces delays:

Key Changes

- BOEM slowed environmental reviews and leasing

- Reduced federal permitting support

- Halted new offshore lease sales

- Investor uncertainty due to policy delays

Impact on Projects

- No major floating wind construction expected in 2025

- Site surveys delayed

- Ports and supply chain planning slowed

Although state-level initiatives and developer commitments suggest the sector is paused, not dead.

According to NREL, the floating offshore wind sector has stalled at the federal level; it is actively advancing at the state level in California and Maine. The future of the industry depends on whether developers can address federal policy uncertainty while building the necessary port infrastructure and state commitments.

State-by-State Floating Offshore Wind Analysis (2025 Status)

California

- Morro Bay (4 GW) and Humboldt Bay (0.6 GW) leases were awarded pre-2025.

- Construction is delayed due to federal permitting slowdowns.

- State-level policies remain supportive: The California Energy Commission continues environmental and grid studies.

- Ports in Los Angeles and San Francisco are being upgraded to handle turbine components.

Oregon

- Lease areas in early BOEM review, ~1.2 GW potential.

- Developers: Equinor, Principle Power, and others are conducting site surveys.

- Environmental assessments are paused, but state incentives remain active.

Washington

- Early-stage studies are underway for floating wind sites near Puget Sound.

- 2025 delays due to federal review, but ports and grid connections planning continue.

- Focus on deep-water floating wind turbines USA to meet the Pacific Northwest wind potential.

Maine

- Gulf of Maine lease areas (~1 GW) remain on track with local support.

- State initiatives encourage workforce development and supply chain readiness.

- Developers are preparing detailed environmental assessments, pending federal approvals.

Hawaii

- Islands have massive deep-water potential (~6 GW).

- Projects are delayed due to permitting, but interest remains high.

- Floating wind could complement solar + battery storage to achieve renewable targets.

You can explore more regional market insights in our Global Wind Markets section

Technology Innovations and Supply Chain Readiness

Key Technological Advancements

- 15–20 MW turbines are under development to reduce the Levelized Cost of Energy (LCOE).

- Semi-submersible and TLP designs tested in Europe were adapted for U.S. conditions.

- Advanced mooring systems improve stability in deep waters and hurricanes.

Digital Tools

- AI-driven predictive maintenance reduces downtime.

- Sensor-based monitoring allows real-time ocean and turbine analysis.

- Digital twins simulate turbine behavior for risk mitigation.

Supply Chain Challenges

- U.S. ports require upgrades to handle massive turbine components.

- Limited U.S.-based floatable platform manufacturing.

- Dependence on European/North American component suppliers for 2025 projects.

For full coverage on innovations and engineering breakthroughs with the deepwater offshore wind technology USA, visit Wind Turbine Innovations

Costs, Financing, and Investment Landscape

Cost Trends

- Current floating offshore wind United States LCOE: ~$120–150/MWh (early-stage)

- Target (DOE Floating Offshore Wind Shot): 70% reduction by 2035 → ~$40–45/MWh.

- Higher costs than fixed-bottom turbines due to deep-water foundations and mooring.

Financing Considerations

- Investment slowed in 2025 due to permitting uncertainty.

- Developers leverage EU experience and global green finance for partial risk mitigation.

- Insurance costs are higher for deep-water turbines; long-term contracts are essential.

Investment Outlook

- The 2025 slowdown is temporary; global interest remains high.

- Private-public partnerships and offshore wind bonds are being explored.

- Early movers like Equinor, Shell, and RWE maintain strategic positions.

Developer Positioning and Project Timelines

Major Developers in U.S. Floating Wind

- Equinor: Pioneer, focusing on California and Maine.

- Shell: Long-term plan for Pacific Coast turbines.

- RWE & Ocean Winds: Active in Oregon and Washington studies.

- Copenhagen Infrastructure Partners: Portfolio diversified with European floating wind experience.

2025 Timelines

- Few projects are breaking ground; most are in pre-permit or environmental assessment.

- Expected construction resumes: 2026–2027 for some Pacific Coast sites.

- Workforce training and port readiness are ongoing, preparing for post-permit acceleration.

U.S. Floating Offshore Wind Market Forecast (2025–2040)

2025–2027 (Stagnation + Slow Development)

- Minimal new approvals due to paused BOEM activity.

- Developers focus on engineering, environmental studies, and port upgrades.

- California, Maine, and Oregon remain the most active planning zones.

- Expect no major construction starts in 2025.

2028–2030 (Gradual Restart + Policy Rebound Likely)

- Historical trend: every U.S. administration eventually supports offshore wind for economic growth.

- New BOEM reviews are expected by 2027–2028.

- Ports like Humboldt, Morro Bay, and Portland (Maine) are operational with upgrades.

- The first floating prototypes in U.S. waters are likely by 2029.

2030–2035 (Major Scaling Phase)

- 10–12 MW turbines replaced by floating 18–20 MW class machines.

- U.S. manufacturing capacity expands—fewer imports from Europe.

- DOE expects a dramatic cost decline (up to 70% by 2035).

- At least 3–5 GW of floating projects could begin construction.

2035–2040 (Rapid Deployment + Cost Parity)

- Floating wind becomes cost-competitive with new natural gas plants in coastal states.

- The U.S. grid begins integration of multi-state offshore transmission networks.

- 8–15 GW of floating wind could be operating across the West Coast and Northeast.

Supply Chain Gaps Holding Back U.S. Leadership

Port Infrastructure

- U.S. ports were designed for shipping containers—not massive turbine blades or floating platforms.

- Only a few ports can handle 15–20 MW turbines without upgrades.

- California needs deepwater assembly hubs due to turbine height.

Manufacturing

- Floating platforms rely on heavy steel fabrication; the U.S. lacks sufficient domestic capacity.

- Europe dominates spar buoy & semi-sub platform technology.

- The U.S. must build modular fabrication yards to avoid costly imports.

Workforce

- The U.S. will need 30,000–40,000 trained offshore workers for floating wind by 2035.

- Electricians, marine engineers, and rope access technicians are in short supply.

- The Gulf of Mexico oil workforce offers strong transition potential.

Transmission

- Offshore-to-onshore grid upgrades are too slow.

- West Coast grid congestion limits near-term floating wind integration.

- Requires coordinated federal and state investment.

Global Competition (Where the U.S. Stands in 2025)

Countries Leading Floating Wind

- UK & Scotland – First commercial-scale floating wind farms (Hywind Scotland, Kincardine).

- Norway—global leader in floating turbine design and offshore engineering.

- Japan – Testing multiple deep-water prototypes.

- South Korea – Aggressive investment, 6–8 GW pipeline.

The U.S. Position

- Gigantic deep-water wind resources (West Coast, Hawaii, Gulf of Maine).

- Strong research institutions: NREL, DOE, and Pacific Northwest labs.

- But policy pauses keep the U.S. behind Europe and Asia in 2025.

Opportunity

If permitting stabilizes post-2025, the U.S. could become the world’s #1 floating wind market by the 2030s, due to >80% of offshore wind potential being in deep waters.

Investment Outlook—Will Floating Wind Recover After 2025?

Short-term (2025–2027)

- High uncertainty.

- Investors pause large commitments.

- Only engineering, environmental, and port studies continue.

Mid-term (2028–2032)

- Offshore wind rebounds historically after slowdowns.

- Tax incentives return under new federal policy or bipartisan energy laws.

- American utilities begin signing long-term power contracts.

Long-term (2032–2040)

- U.S. floating wind becomes a major global industry.

- Low-cost floating turbines are produced domestically.

- Supply chain jobs exceed 50,000+.

- Hydrogen and offshore wind integration becomes common.

For insights on how floating wind competes globally with the offshore wind policy 2025, visit Global Offshore Wind

Will Floating Offshore Wind Succeed in America?

More than 40 federal grants totaling $50 million were suspended or canceled across the University of Maine system in 2025, impacting research and student programs. According to expert assessments by NREL, McKinsey, Wood Mackenzie, major U.S. universities, GWEC Global Offshore Wind Report, PNNL, and Hitachi Energy,

- Floating offshore wind is technically feasible and strategically essential to the United States.

- These experts consistently warn that it will require more than $20 billion in investments between the late 2030s and 2040s to achieve success. But investment also depends on port upgrades, long-term policy stability, a mature domestic supply chain, and expected cost reductions.

- While the United States faces temporary setbacks and global competition, the consensus among experts is clear: Floating offshore wind will ultimately succeed in America if investment, infrastructure, and political commitment come together—but not immediately, but steadily.

The reason why floating offshore wind will ultimately succeed in the US is significant:

- The global resource potential is unmatched.

- Energy demand from data centers, EVs, and AI is doubling the grid’s demand.

- Coastal states cannot rely solely on solar power, which is one reason.

- Deepwater wind provides regular nighttime power.

- Technology costs are expected to drop significantly by 2030.

- Each administration ultimately helps with energy security and job creation.

2025 = Pause

2028 onwards = Restart

2035-2040 = Massive scaling

To understand technician and workforce needs in floating wind, read our Wind Energy Jobs section

Conclusion

Floating offshore wind in the United States is experiencing a temporary slowdown in 2025—but not a stop.

With unmatched deep-water resources, rising electricity demand, and long-term cost reductions ahead, floating wind will become a core pillar of U.S. clean energy between 2035 and 2040.

The U.S. is stalled—but still on track.

FAQ

Q: Where is floating offshore wind being developed in the U.S.?

A: Primarily in deep-water regions like the West Coast, which require floating foundations due to water depth.

Q: What limits faster deployment?

A: High capital costs, technical complexity, and infrastructure constraints slow large-scale development.

Ismot Jerin is the founder and Editor-in-Chief of WindNewsToday, an independent publication covering offshore wind, renewable energy policy, and clean power markets with an analytical focus on the United States and global energy transition.