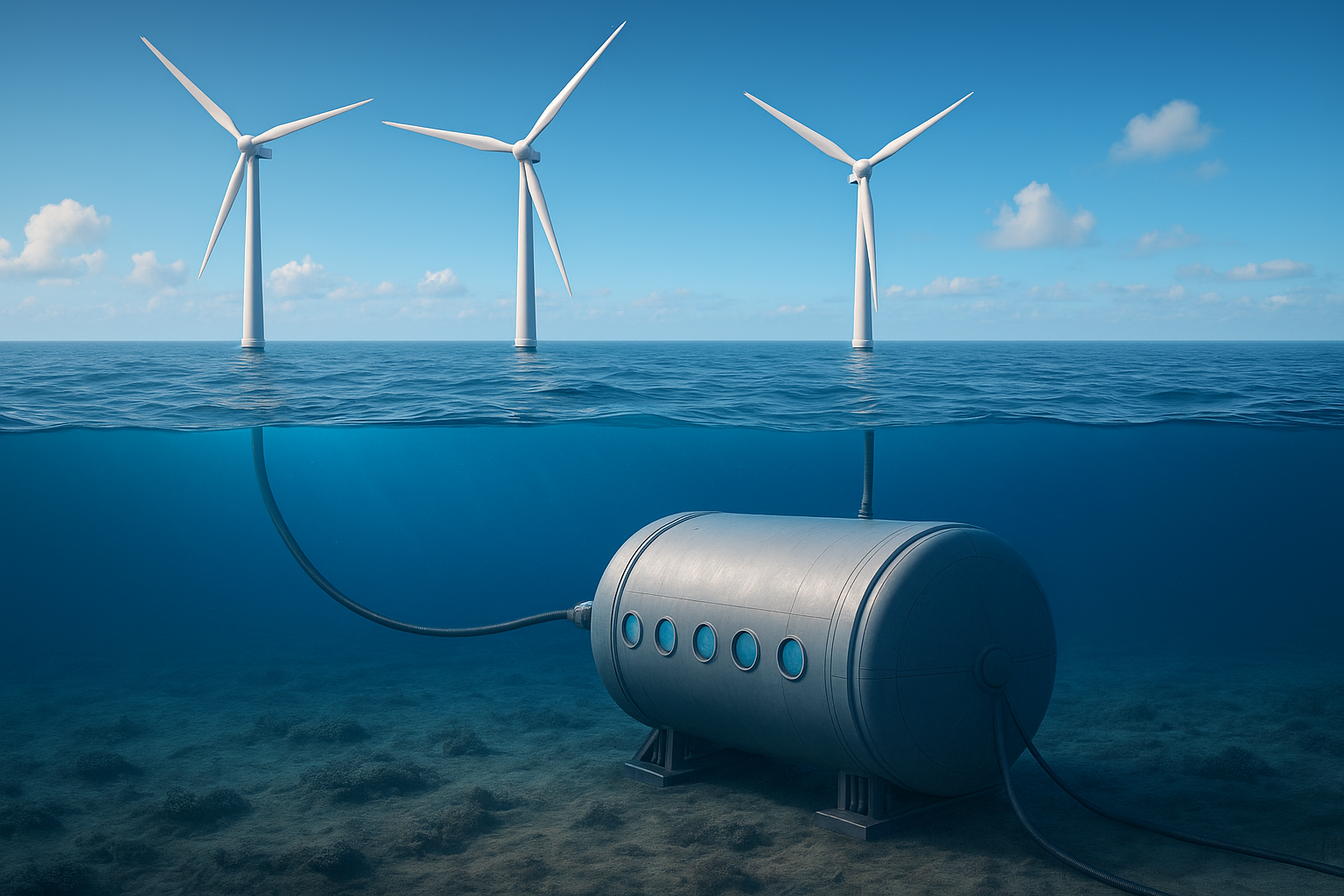

China is setting a global benchmark by launching the world’s first offshore wind-powered underwater data center (UDC) in Shanghai’s Lingang Special Area. Developed by HiCloud, the 500 MW subsea project combines renewable energy and digital innovation, redefining sustainable cloud computing. This milestone highlights the potential for AI, data infrastructure, and offshore wind energy to converge for a low-carbon digital future.

Learn more about wind energy and AI in wind turbines to see how technology and clean energy intersect.

China Offshore Wind Data Center Sets a Global Benchmark

China has officially finished the construction of the world’s first offshore wind data center, an underwater data center (UDC) in Shanghai’s Lin-gang Special Area. The project, inaugurated on Tuesday, represents a significant milestone in integrating renewable energy with digital infrastructure. With an investment of 1.6 billion yuan (approximately 226 million U.S. dollars) and a total power capacity of 24 megawatts, the UDC is designed to showcase green and low-carbon computing on a global scale.

Unlike traditional land-based data centers, this innovative project utilizes over 95% green electricity, reduces power consumption by 22.8%, and cuts water and land use by nearly 100% and 90%, respectively. These measures demonstrate China’s commitment to sustainable digital development and offshore wind energy consumption.

HiCloud Demonstrates Wind-Powered Underwater Data Center

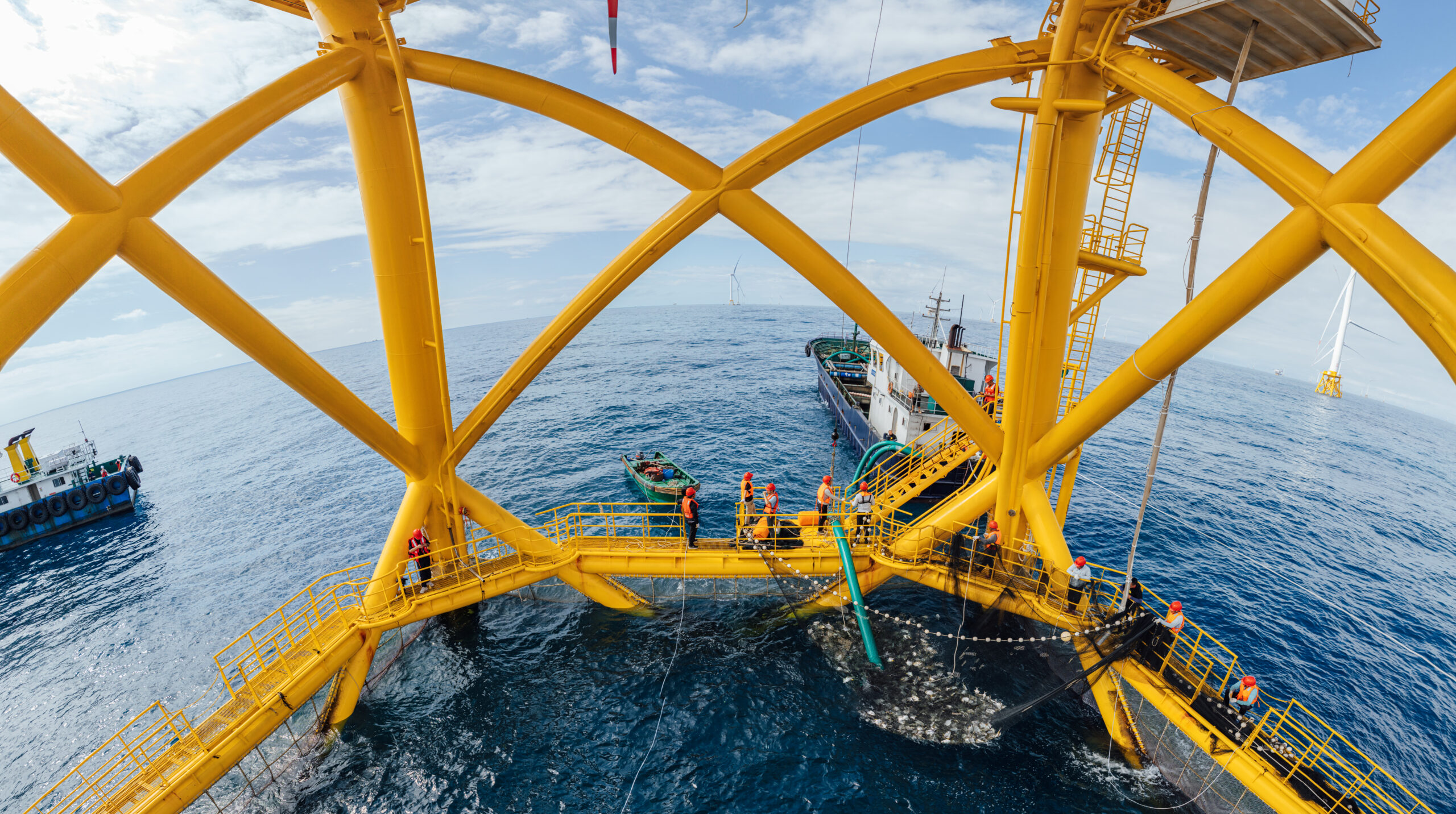

Chinese underwater data center firm HiCloud, a division of Highlander, also launched a demonstration project that connects servers directly to an offshore wind farm. The initiative marks the first stage of a plan to scale subsea deployments up to 500 MW. The demonstration site, offering 2.3 MW of data center space, is located off the coast of Shanghai near the Lingang Special Area of the Shanghai Pilot Free Trade Zone.

HiCloud highlighted the significance of this project, stating on LinkedIn:

“This marks a significant milestone for the Lingang Special Area in deeply integrating the digital economy, new energy, and the marine economy. It also represents a major initiative by Shanghai to support national strategies and build a global hub for technological innovation.”

Industrial partners—including Shenergy Group, Shanghai Telecom, Shanghai INESA, and CCCC Third Harbor Engineering Company—signed a cooperation agreement to collaborate on building a 500 MW underwater data center. While the exact location and timeline for large-scale construction have not been disclosed, the announcement signals an ambitious roadmap for wind-powered subsea computing in China.

The Rise of Underwater Data Centers Globally

The innovation of underwater data centers is not entirely new. Microsoft pioneered the effort with Project Natick, launching the first U.S.-based underwater data center off the Pacific coast in 2015 and following up with a pilot in the North Sea in 2018. However, Microsoft later abandoned these projects, leaving room for other companies to innovate. At least two start-ups, Subsea Cloud and NetworkOcean, are now planning their own underwater data centers, positioning China as a global leader in this niche.

HiCloud’s experiments date back to 2021, starting with deployments off Hainan Island. Its first commercial UDC went live in 2023, and in February 2025, an additional module containing 400 high-performance servers was added. This iterative approach highlights the growing viability and scalability of underwater data infrastructure when coupled with offshore wind energy.

Renewable Energy and Data Centers: The Global Trend

Currently, data centers globally consume 2–3% of the world’s electricity, and a single hyperscale data center requires the equivalent power of roughly 10,000 homes per day. Recognizing the environmental impact, major tech companies are increasingly turning to renewable energy.

Amazon, Google, Microsoft, Equinix, Digital Realty, and Schneider Electric have made significant commitments: purchasing clean energy, partnering with renewable developers, and building data centers powered by wind and solar energy. For instance, Google recently connected its Oklahoma data center directly to a wind farm, while Amazon aims to operate all of its global operations using 100% renewable energy.

China’s offshore wind-powered underwater data centers follow the same global trend, demonstrating how AI, digital infrastructure, and offshore renewable energy can converge to reduce emissions, improve efficiency, and set benchmarks for sustainable cloud computing worldwide.

Advantages of China’s Offshore Wind-Powered UDCs

Reduced Environmental Impact: Nearly total eradication of land and water use, 22.8% reduction in power consumption, and over 95% green electricity usage.

- Scalable Design: A 500 MW subsea deployment is planned after the 2.3 MW pilot demonstration.

2. Technological Leadership: Showcases innovation by combining wind energy, underwater modules, and AI-powered servers.

3. Economic Integration: Promotes the growth of the digital economy and the marine industry while supporting national strategies.

4. Global Benchmarking: Establishes China as a pioneer in data infrastructure driven by renewable energy, encouraging comparable initiatives around the world.

Conclusion: A Green Digital Future

China’s offshore wind-powered underwater data center is a game-changer for the global energy and technology sectors. Projects like HiCloud’s 500 MW plan, which integrates digital infrastructure, renewable energy, and sustainable practices, not only lessen their impact on the environment but also establish new benchmarks for the combination of clean energy and computing.

China’s innovative efforts will probably serve as a model for sustainable data centers globally as major global players opt for renewable energy, showing how the next generation of cloud computing can be both environmentally friendly and high-performing.

Source: Xinhua

Ismot Jerin is the founder and Editor-in-Chief of WindNewsToday, an independent publication covering offshore wind, renewable energy policy, and clean power markets with an analytical focus on the United States and global energy transition.