Trump Offshore Wind Policy Shocks 5-Year Forecast Drop 25%

The global renewable energy market is bracing for turbulence as President Donald Trump offshore wind policy sends shockwaves through the industry. According to a new report from the International Energy Agency (IEA), the forecast for global offshore wind capacity growth has been cut by more than 25% over the next five years—a direct result of the Trump administration’s renewed push for fossil fuels and tightened restrictions on clean energy projects.

U.S. Policy Shift Alters Global Renewable Trajectory

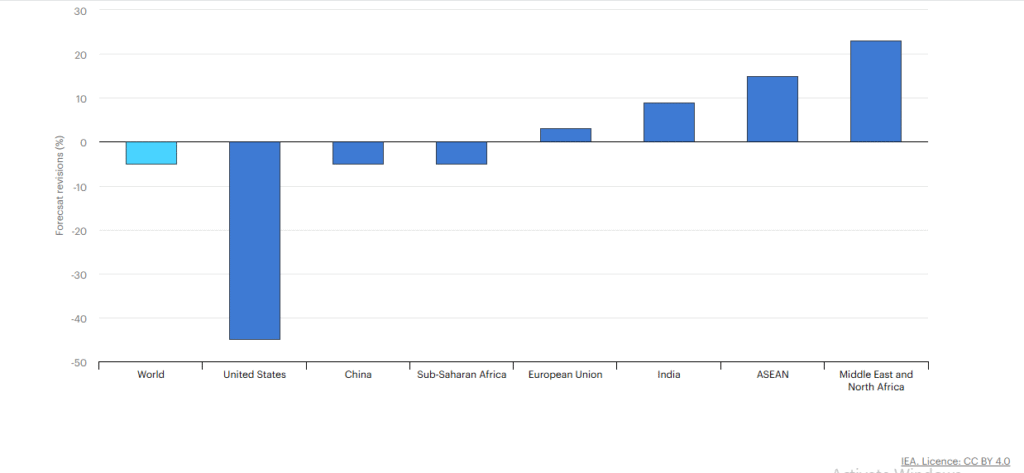

The IEA’s revised outlook paints a stark picture: the forecast for renewable energy generation between 2025 and 2030 is now 5% lower than last year’s estimate, with the U.S. share slashed by nearly 50%.

Policy changes under the Trump administration have contributed heavily to the downgrade. These include the following: Offshore wind industry outlook

- Early withdrawal of federal tax credits for clean energy developers.

- A freeze on new offshore wind leases.

- A cap on permits for onshore wind and solar PV projects on federal land.

- Import restrictions on wind turbine components and rare-earth materials.

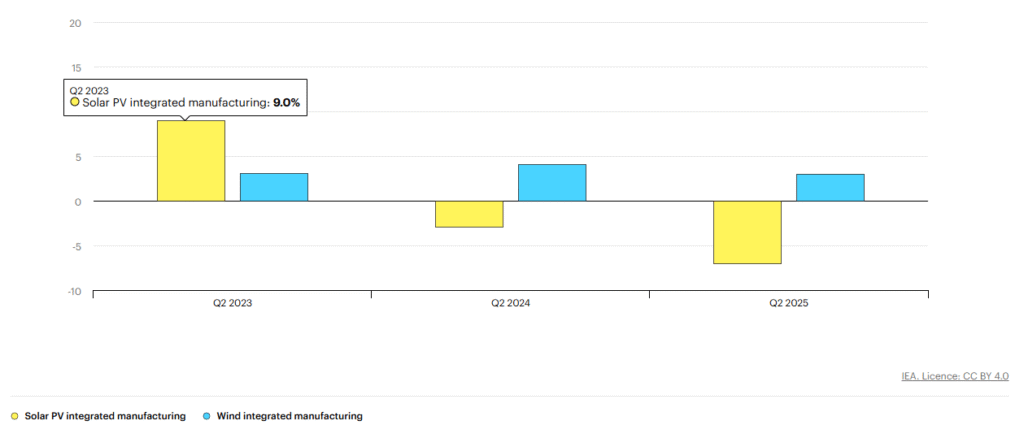

The result: a wave of project cancellations, delays, and investor uncertainty across the U.S. renewable landscape.

Offshore Wind Industry Faces a 25% Growth Collapse

The most dramatic impact has fallen on the offshore wind sector, once seen as a cornerstone of America’s clean energy transition. The IEA report now predicts that offshore wind capacity growth will be 25% lower than previously projected over the next five years.

Developers like Ørsted, RWE, and Equinor have already scaled back 2030 offshore wind capacity growth targets, citing rising costs, long permitting delays, and the chilling effect of new federal restrictions.

“The new Trump energy policy marks a turning point,” said an industry analyst. “It could undo years of progress in offshore wind just as the U.S. was starting to compete with Europe and China.”

China Surges Ahead Despite Policy Adjustments

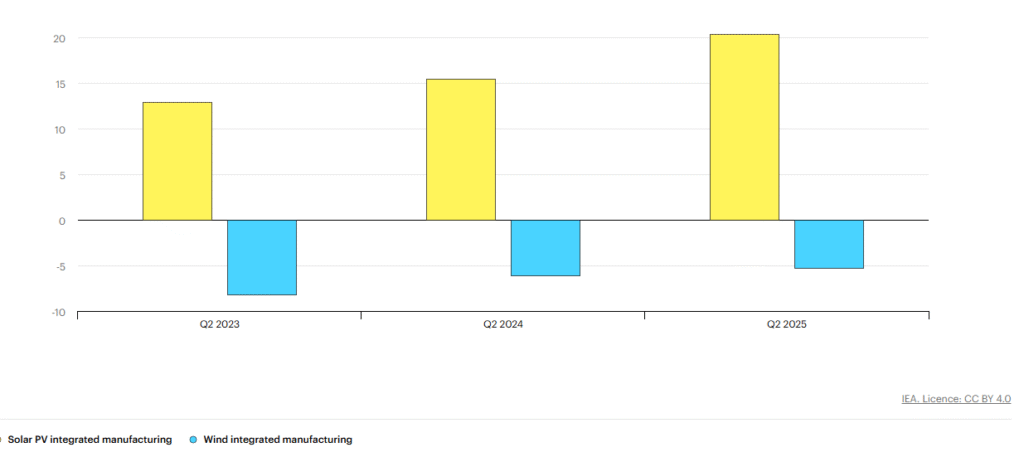

While the United States steps back, China continues to surge ahead—accounting for about 60% of global renewable power capacity growth.

Though China recently shifted from fixed tariffs to competitive auctions (causing a temporary slowdown), it remains on track to reach its 2035 wind and solar targets five years early. The contrast between the two largest economies highlights a widening gap in global clean energy leadership.

Trump’s Fossil Fuel Agenda Returns

The IEA report also notes that President Trump’s return to the White House in January for a second term has brought with it a clear shift in energy priorities. Trump has pledged to expand oil, gas, and coal production while arguing that renewables are “too costly and unreliable.”

Critics warn that such a stance could undermine America’s climate commitments and job growth in the renewable sector. Offshore wind projects—particularly those planned off the East Coast—are already facing multi-billion-dollar setbacks.

Market Reaction: Global Developers Reconsider U.S. Expansion

Investors and energy developers are responding cautiously. Some companies have paused offshore wind investments in U.S. waters, redirecting funds toward European and Asian markets where policy support remains strong.

“Uncertainty is the biggest threat,” said a senior executive from a European renewable developer. “Policy reversals make long-term investment planning nearly impossible.”

Meanwhile, states like New York and Massachusetts are trying to push forward with their offshore projects independently—but without federal backing, their timelines and incentives could face significant delays under Trump renewable energy policy.

The Broader Impact on Clean Energy Ambitions

The new 25% offshore wind forecast cut doesn’t just impact future turbines—it represents a potential loss of thousands of jobs, billions in investment, and slower progress toward emission targets.

Industry experts argue that offshore wind remains vital to meeting global net-zero goals, providing a reliable large-scale renewable source. A prolonged slowdown could have cascading effects across supply chains, port infrastructure, and coastal economies.

Outlook: Can the U.S. Regain Momentum?

Despite the grim short-term outlook, analysts believe the U.S. offshore wind industry could recover if political and policy shifts occur before 2030. Bipartisan support for energy security and local manufacturing might still bring new opportunities.

For now, the Trump offshore wind policy stands as a major turning point—reshaping not just America’s clean energy trajectory but also the global race toward renewable dominance.

Stay updated with the latest on U.S. offshore wind policy, global renewable investments, and industry forecasts—follow WindNewsToday for breaking updates and expert insights.