Last Updated: January 2026

Author: WindNewsToday Editorial Team

For nearly a decade, the promise of US offshore wind 2025 has oscillated between bold ambition and structural uncertainty. Yet as 2025 comes to a close, the narrative is quietly shifting. After canceled power purchase agreements (PPAs), inflation-driven cost resets, and supply chain disruptions, the US offshore wind industry is no longer stalled—it is recalibrating.

This moment matters because what once looked like stagnation in 2023–2024 has evolved into a more disciplined and resilient phase of development. Projects moving forward today are driven by realistic pricing, regulatory clarity, and execution-focused planning.

After years of uncertainty, 2025 marks a turning point for US offshore wind. Projects moving forward today will define the industry’s scale, cost structure, and credibility for the next decade.

For a full foundation-level overview, see our Offshore Wind Energy Explained guide.

Table of Contents

A New Phase for US Offshore Wind Development

While headlines over the past two years focused on delays and developer exits, underlying industry data tells a more nuanced story.

By the end of 2025:

- Federal offshore wind approvals reached record levels

- Domestic supply chains stabilized after inflation shocks

- Port infrastructure investments accelerated

- Several major projects moved from planning into active construction

This is not a boom cycle.

This is foundation-building for long-term offshore wind capacity in the United States.

US Offshore Wind Projects Actually Moving Forward (End of 2025)

Below is a project-by-project snapshot based on public progress updates, developer statements, and federal filings—summarized into clear, analytical insights.

Vineyard Wind 1 — Massachusetts

Status: Construction, nearing completion

Capacity: 800 MW

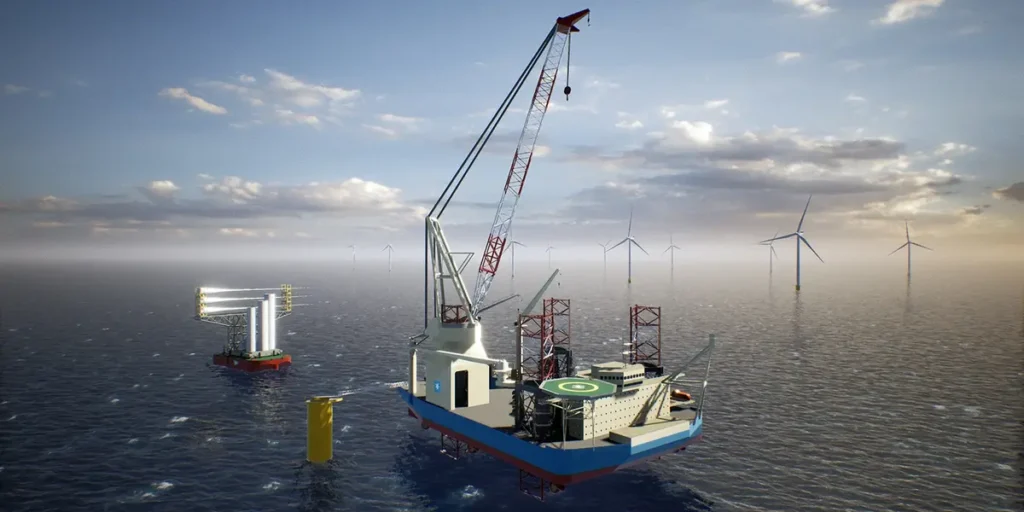

Vineyard Wind remains the closest example of a stabilizing project. After slowdowns caused by weather windows and marine logistics, 2025 saw steady turbine installations and export cable integration.

Why it matters:

It proves that large-scale offshore wind is technically deliverable on US coastlines despite early policy turbulence.

South Fork Wind — New York

Status: Fully operational

Capacity: 132 MW

South Fork wind, NY’s first offshore wind farm and the first operational commercial-scale US offshore wind farm. Its full operation has given policymakers and investors something they critically needed: a domestic success story.

Key takeaway:

South Fork’s operational uptime and grid performance are exceeding early expectations—something that strengthens the case for subsequent New York and New England procurement rounds.

Coastal Virginia Offshore Wind (CVOW) — Virginia

Status: Rapid advancement in foundation installation

Capacity: 2.6 GW (full buildout)

Dominion Energy’s enormous CVOW project is the most structurally important development of 2025. The scale, engineering precision, and logistics coordination have become a national benchmark.

Why is it moving forward:

Stable cost recovery mechanisms and long-term planning have allowed construction to proceed despite broader industry headwinds.

Empire Wind & Beacon Wind — New York

Status: Permitting clarified, contracts renegotiated, development back on track

Developer: Equinor

After a turbulent period of contract restructuring, Equinor realigned its financing model and returned these projects to active development.

Signal to watch:

New York’s procurement strategy has shifted toward realistic pricing and long-term grid planning—an essential correction.

Ocean Wind Area Developments (Post-Orsted Exit) — New Jersey

Status: Redevelopment phase

Importance: High political visibility

Following Orsted’s withdrawal in 2023–2024, the area is now being revived through alternative partnerships and state-level interest.

Why this matters:

New Jersey remains one of the strongest long-term resource zones. Developers understand this region will return—it’s a question of timing and cost structure, not viability.

Vineyard Wind South / Commonwealth Wind

Status: Redesign + supply chain realignment

Developer: Avangrid

Avangrid shifted these projects into revised bidding structures that better reflect current costs. Unlike cancellations seen in earlier cycles, these redesigns are strategic pauses, not project failures.

Key point:

Developers are learning to price with real-world US supply chain realities—not European assumptions.

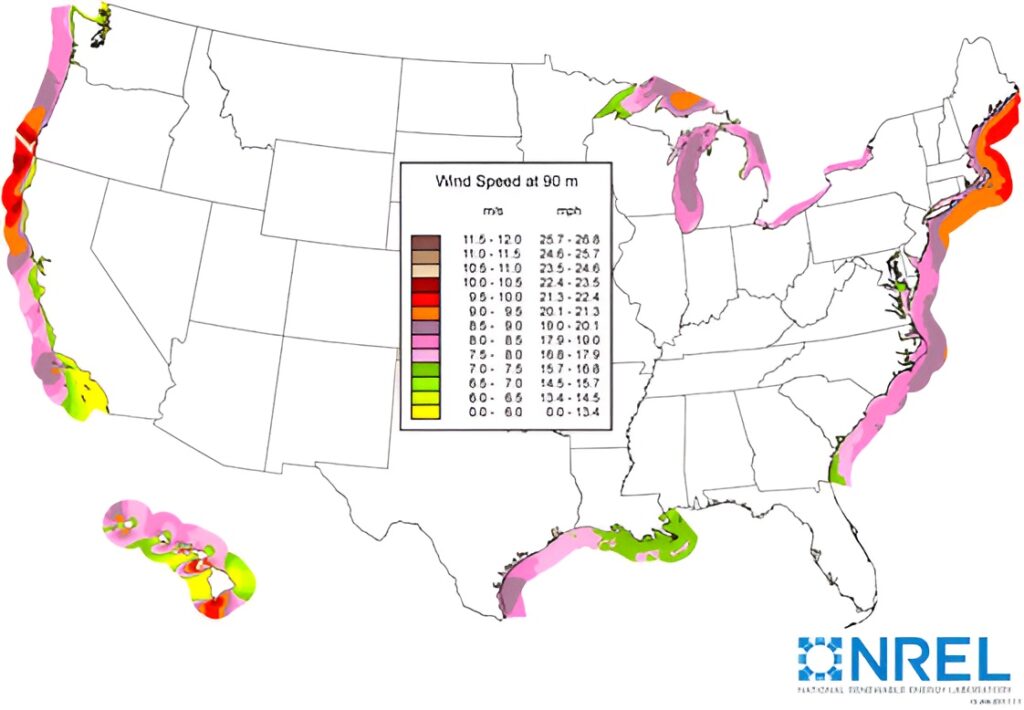

Floating Offshore Wind Progress — US West Coast

Status: Early-stage momentum but meaningful forward movement

Regions: California & Oregon

The Pacific Coast remains early in deployment but is seeing real movement:

- Port upgrades

- Design partnerships

- Federal planning zones

Commercial-scale deployment remains post-2029, but groundwork is finally visible.

For technology comparisons, see Floating vs Fixed-Bottom Offshore Wind.

Why Some Projects Are Moving While Others Stall

Developers and analysts agree that the biggest differences between progressing and paused projects come down to three factors:

1. Contract Structure

Projects with flexible PPAs—or the ability to renegotiate—survived.

Fixed-price contracts did not.

2. Supply Chain Readiness

Virginia, New York, and Massachusetts invested early in ports.

This is now paying dividends.

3. State Procurement Strategies

States that adapted fast to inflation (MA, NY, VA) unlocked progress.

States that waited (NJ earlier on) faced setbacks but are now recovering.

What This Moment Really Means for US Offshore Wind 2025

The US offshore wind industry has shifted from ambition-first to execution-first.

This reset was not a collapse—it was a correction.

Projects advancing today are stronger, better priced, and structurally aligned with long-term energy planning. If permitting clarity and infrastructure investment continue, the period from 2026–2030 is likely to resemble early-stage UK offshore wind scaling.

The projects moving forward now will form the backbone of the industry’s next decade.

Conclution

As 2025 comes to a close, the story of US offshore wind is finally shifting from uncertainty to direction. The early turbulence—contract failures, inflation pressures, supply chain delays—was not a collapse but a correction the industry ultimately needed. The projects advancing now are stronger, better structured, and far more realistic than the first wave of procurement.

Vineyard Wind 1 and South Fork have demonstrated that large-scale offshore wind is technically viable in US waters. Coastal Virginia Offshore Wind has shown how long-term planning and stable utility models can unlock multi-gigawatt progress. New York’s restructured projects reflect a more disciplined, cost-aligned development path. And even states that faced setbacks, like New Jersey, are beginning to reposition themselves for a more reliable next chapter.

The most important shift is not in the number of turbines installed, but in the maturity of the industry itself. After years of hype and volatility, the United States finally has an offshore wind sector built on measurable progress, phased construction, and credible economic value. That foundation will shape everything that happens from 2026 to 2030.

If policymakers remain consistent and developers continue designing with real-world costs, the next decade will move the US from an emerging offshore wind player to a global competitor. The reset is over—and the rebuilding has begun.

FAQ

Q: Why is US offshore wind 2025 important?

A: 2025 represents a turning point as projects move forward with realistic pricing, regulatory clarity, and execution-focused planning.

Q: Which factors affected offshore wind progress before 2025?

A: Delayed PPAs, inflation-driven cost resets, and supply chain disruptions slowed development in 2023–2024.

Ismot Jerin is the founder and Editor-in-Chief of WindNewsToday, an independent publication covering offshore wind, renewable energy policy, and clean power markets with an analytical focus on the United States and global energy transition.