Trump Offshore Wind Policy Shocks 5-Year Forecast Drop 25%

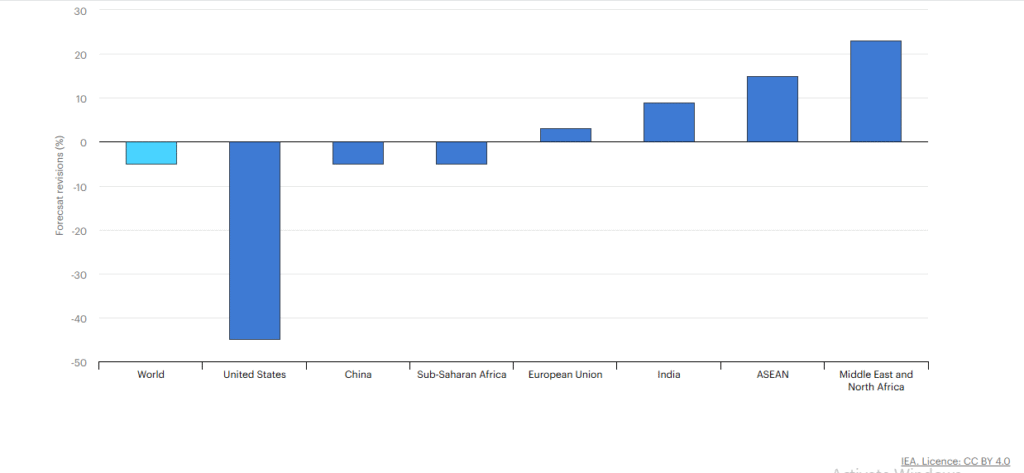

The global renewable energy market is bracing for turbulence as President Donald Trump offshore wind policy sends shockwaves through the industry. According to a new report from the International Energy Agency (IEA), the forecast for global offshore wind capacity growth has been cut by more than 25% over the next five years—a direct result of the Trump administration’s renewed push for fossil fuels and tightened restrictions on clean energy projects.

U.S. Policy Shift Alters Global Renewable Trajectory

The IEA’s revised outlook paints a stark picture: the forecast for renewable energy generation between 2025 and 2030 is now 5% lower than last year’s estimate, with the U.S. share slashed by nearly 50%.

Trump renewable energy policy changes really dragged things down. Take the offshore wind industry outlook, for example.

- Developers lost federal tax credits sooner than expected.

- The government stopped offering new offshore wind leases.

- They also put a lid on permits for wind and solar projects on federal land.

- Plus, import restrictions made it harder to get wind turbine parts and rare-earth materials.

All of this led to canceled projects, delays, and lots of nervous investors—renewables in the U.S. took a real hit.

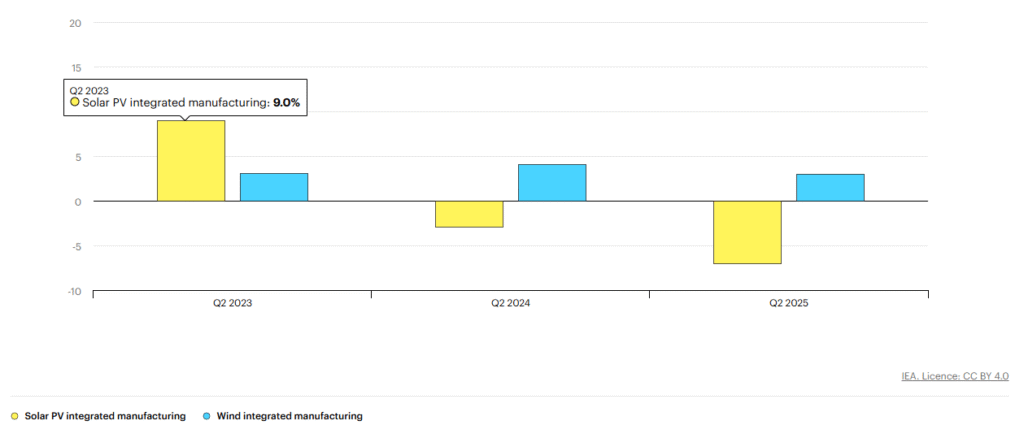

Offshore Wind Industry Faces a 25% Growth Collapse

Offshore wind has taken the hardest hit—once the pride and joy of America’s clean energy push, now it’s losing momentum fast. The IEA says offshore wind capacity growth is 25% less than they thought just a year ago. That’s a big drop. Developers like Ørsted, RWE, and Equinor aren’t just talking about slowing down.

They’ve actually cut their 2030 goals for new offshore wind forecasts, blaming higher costs, endless waits for permits, and a wave of new federal rules that have spooked the whole industry.

“The new Trump renewable energy policy changes everything,” one analyst said. “It threatens to wipe out years of progress in offshore wind, right when the U.S. was finally starting to catch up to Europe and China.”

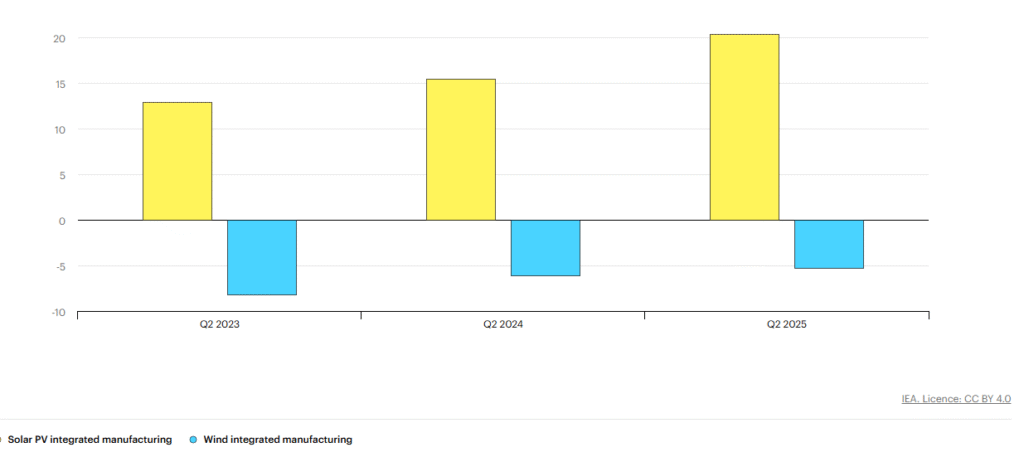

China Surges Ahead Despite Policy Adjustments

While the U.S. pulls back, China just keeps pushing forward. Right now, it’s driving about 60% of the world’s growth in renewable power. China did slow down a bit when it dropped fixed tariffs and switched to competitive auctions, but that pause didn’t last long. The country’s still set to hit its 2035 wind and solar goals five years ahead of schedule.

When you look at the two biggest economies side by side, the gap in clean energy leadership just keeps getting wider.

Trump’s Fossil Fuel Agenda Returns

The IEA report also notes that President Trump’s return to the White House in January for a second term has brought with it a clear shift in energy priorities. Trump has pledged to expand oil, gas, and coal production while arguing that renewables are “too costly and unreliable.”

Critics warn that such a stance could undermine America’s climate commitments and job growth in the renewable sector. Offshore wind projects—particularly those planned off the East Coast—are already facing multi-billion-dollar setbacks.

Global developers are hitting pause on U.S. expansion.

Investors and energy companies are pulling back, shifting their focus to Europe and Asia, where the rules are clearer and governments are still offering strong support.

“Uncertainty is the biggest threat,” one senior executive from a European renewable firm said. “When policies flip-flop, it’s almost impossible to plan for the long haul.”

States like New York and Massachusetts aren’t giving up—they’re trying to keep their offshore wind projects alive on their own. But without help from the federal government, they’re staring down delays and shrinking incentives, especially with Trump’s latest stance on renewables.

The Broader Impact on Clean Energy Ambitions

Cutting offshore wind targets by 25% isn’t just about fewer turbines in the water. It means thousands of jobs lost, billions in investment slipping away, and progress on emission goals stalling. Industry experts don’t mince words: offshore wind is essential for hitting net-zero targets.

It’s one of the few options for large-scale, reliable clean energy. If this slowdown drags on, expect ripple effects—supply chains strained, ports underused, and coastal economies taking the hit.

Outlook: Can the U.S. Regain Momentum?

The short-term picture looks rough, but there’s still hope for the U.S. offshore wind industry. If the political winds shift before 2030, things could turn around. Both sides of the aisle care about energy security and local jobs, so there’s a real chance for new growth. Right now, Trump’s offshore wind policy marks a big shift.

It’s not just changing the path for clean energy in the U.S.—it’s shaking up the global race for renewables, too. Want the latest on U.S. offshore wind, global investments, and what’s next for the offshore wind industry outlook?

Follow U.S. Wind News for real-time updates and expert takes.

Ismot Jerin is the founder and Editor-in-Chief of WindNewsToday, an independent publication covering offshore wind, renewable energy policy, and clean power markets with an analytical focus on the United States and global energy transition.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.info/sl/register?ref=I3OM7SCZ